April 19, 2018

Vital Signs 16 is the latest edition of an annual report published by the Baltimore Neighborhood Indicators Alliance-Jacob France Institute at the University of Baltimore that provides detailed statistics on more than 100 indicators of neighborhood health and vitality in Baltimore and analyzes how these indicators change over time. Included in this year’s report is a new data story by the 21st Century Cities Initiative investigating small business access to capital in Baltimore. As a follow up to our report, Financing Baltimore’s Growth: Measuring Small Companies’ Access to Capital, which looked at 16 years of financial transactions to better understand Baltimore’s financing system and the flow of capital to small businesses, our Vital Signs data story details how access to capital looks at the neighborhood level. Read the data story below and read the full Vital Signs 16 report here.

Data Story: Small Business Access to Capital

Baltimore’s small businesses form the backbone of the local economy, providing tax revenue for the city, jobs for residents, and services and identities to neighborhoods and commercial districts. The city’s small businesses are as diverse as the neighborhoods where they are located, ranging from breweries and restaurants to electrical contracting companies and robotics manufacturers to tech startups and cyber security firms.

The Johns Hopkins 21st Century Cities Initiative has been researching the flows of commercial loans, microloans, venture capital and other equity investments, business grants, and other investment vehicles in order to better understand whether the financing system catering to Baltimore’s small businesses is sufficiently expansive and diverse to support the entire landscape of companies and their varying needs for launching, growing, and thriving in Baltimore.

In 2016, small businesses located in the City of Baltimore accessed more than $580 million from over 8,900 loan, equity investment, and grant transactions. These transactions ranged from microloans under $5,000, including one made by a local, nonprofit Community Development Financial Institution (CDFI), to several later stage venture capital funding rounds over $20 million made by Silicon Valley and nationally based venture capital firms. Also included in the data are bank and credit card business loans, Small Business Administration guaranteed loans, and a number of federal, state, and city loan, grant, and investment programs, all of which comprise most of the formal small business financial system. Not included in the dataset are investments from friends and families, as well as loans from small and de novo banks and emerging online lenders.

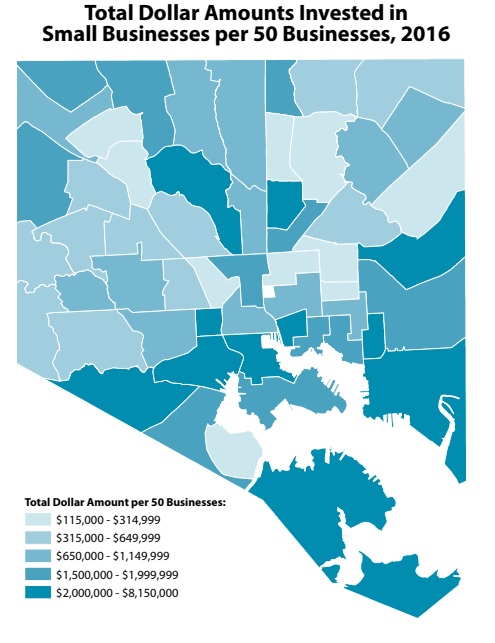

The map reveals telling patterns of investment in small businesses across the city. As might be expected, the downtown, inner harbor neighborhoods that comprise the city’s central business district attracted a large dollar amount of investment in 2016, $110 million* in total, in an area with a total of 793 businesses. Also to be expected, historically underserved markets such as Upton/Druid Heights have a small dollar amount of investments, $560,000*, despite being home to a significant number of businesses, 228 in total. Perhaps somewhat surprising, seemingly isolated neighborhoods that house successful tech and startup incubators, such as the Waverlies, can result in large sums of business investments coming into the community, $10 million* in this case, but relatively few businesses in the neighborhood, just 167. One neighborhood that stands out as a potential model for being home to a healthy, diverse small business community is Southeastern, where a mix of Main Street businesses, port related industries, and tech startups (414 total businesses) received $24 million* in financing in 2016.

Cultivation of a vibrant and growing startup and small business scene is a top priority for a range of public and private stakeholders in Baltimore. This case study illustrates the geographic patterns of investment in small businesses across the city and may prove useful in informing place-based economic development and public-private investment strategies. In addition, ongoing monitoring of these investments and regular reporting can be an effective tool for measuring the success or failure of such strategies.

For more information on the data sources and to read the report Financing Baltimore’s Growth: Measuring Small Companies’ Access to Capital.

*Note: This figure is not adjusted per 50 businesses, as is the case in the map