June 11, 2019

Earlier this year, BB&T and SunTrust Bank announced a proposed merger between the two super-regional U.S. banks, a $66 billion deal that would constitute the largest merger since the 2007 – 2009 financial crisis and result in a bank with $440 billion in assets. If approved, the merger would create the sixth largest bank in the US measured by both assets and deposits. While the scale of this transaction is notable, it is part of a long term trend of bank consolidation in the U.S., with the number of commercial banks falling by half over the past 25 years. The proposed deal prompted concerns about the effect that the merger could have on market competition between community banks and increasingly larger, dominant financial institutions and branch closures in poorer communities. We have an additional concern about how this merger might impact small business lending.

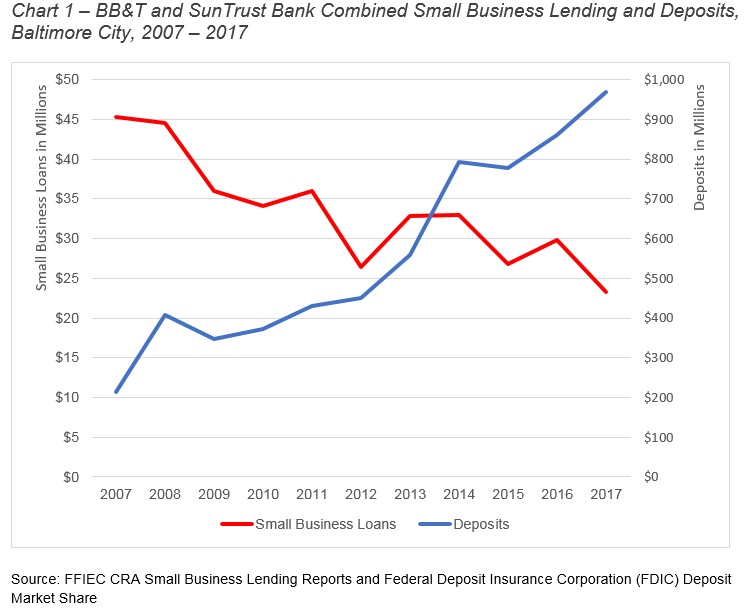

The relocation of BB&T’s and SunTrust Bank’s headquarters from Winston-Salem and Atlanta to Charlotte will undoubtedly have an effect on those markets, but how will the other 78 markets where the banks have overlapping branch operations fare? As a follow on to work we have done over the past two years to study trends in small business lending in Baltimore City, we looked specifically at the small business lending performance of these two banks in this single market. Our focus does not take into account these banks’ lending activity in other areas such as mortgages or larger commercial loans.